![]()

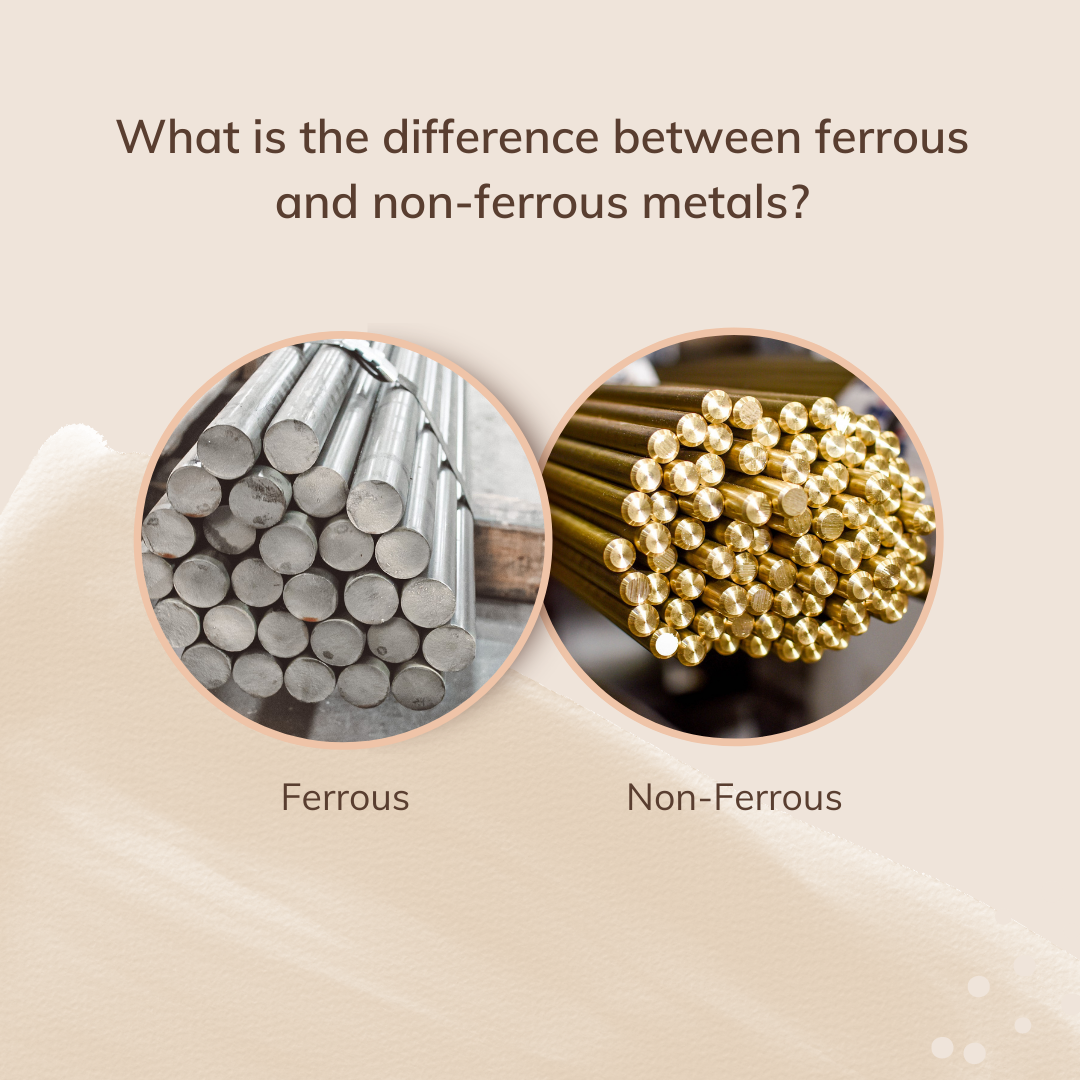

Since early this summer, business publications and blogs around the country have been abuzz following the questionable practices of bank-owned metals warehouses. It is alleged that they have restricted the flow of goods and thus put artificial pressure on prices, particularly aluminum and copper. For months, the Department of Justice and the U.S. Commodity Futures Trading Commission have been investigating. I’ve been regularly asked whether these warehouses are the same as distribution centers like Admiral Metals.

The scrutiny by the Department of Justice of several bank-owned, London Exchange Metal-licensed warehouses began at the urging of companies like MillerCoors, LLC and Coca-Cola, many located outside Detroit. It is suspected that they have manipulated the market by purposefully limiting the supply of aluminum and other LME-traded metals, thereby driving up prices. Low interest rates have provided a favorable environment for banks and traders to purchase commodities like aluminum and copper and sell to speculators at a profit. The goods are then stored and rent is paid to warehouses owned by these same banking institutions.

Delivery delays from these warehouses were common, increasing from 6 weeks to 16 months in recent years. The banks attribute delays to operations, however the metal owners are paid an incentive to keep the metal stored where it is. The banks then release only the mandatory minimum amount of goods, often to another bank-owned warehouse, creating a tight market and artificially higher prices. MillerCoors, LLC estimates the resulting higher metal prices have cost consumers an extra $3 billion a year.

In July, subpoenas were issued by the U.S. Commodity Futures Trading Commission, an independent federal agency that regulates futures and option markets. According to Reuters: “The subpoena ‘included more than 30 areas of interest to the CFTC’, and was particularly focused on ‘anything that relates to moving metal from one [LME licensed] warehouse to another within the same company’… adding it also wanted details of any trading based on prices on the LME.” The LME licenses a network of more than 700 warehouses in 36 locations globally in addition to regulating and monitoring warehousing practices. Current rules require that warehouses release a minimum of 3,000 tons daily. There is no restriction on the maximum amount each warehouse is allowed to take in daily nor oversight of who owns the warehouses where the metal is delivered. The LME is currently reviewing these rules in an attempt to create a stronger link between the amount of metals delivered to the warehouses, and the amount and delivery point of those metals being shipped out.

Further audits, more stringent regulations, increased interest rates and greater competition has eaten into the profitability of bank-owned metal warehousing. As a result, investment banks have begun to sell off these assets. According to Nasdaq.com, “With more of the metal coming back into the market, the charge for immediate delivery has fallen more than 7{41f8e085fc68038a2da2699f98ad8aea8b7e87e25f742017f6f76a0b55118d3c} from the record high in July.” This can only mean more access to supply and more stabilized pricing for aluminum buyers.

Obviously, Admiral Metals is not listed on the London Metals Exchange. Yet, the most basic principles of successful warehousing and distribution should apply regardless of a distribution center’s size and scope: provide uninterrupted supply, efficient transportation, the leveling of market fluctuations, and JIT stocking.

In general, best practices dictate that warehouses make sure there is timely access to a variety of products and in the process, create cost efficiencies for their customers. This is what we aim for every day at Admiral Metals.

A conversation with Admiral’s Operations Manager

Admiral Metals has a unique customer-focused operating philosophy that has been at the foundation of its warehouse practices for many years. The Company’s production is based on the customer need for delivery the next day, unlike most companies that are focused solely on driving yield. “A fast turnaround means our production is streamlined with minimal overstock,” says Don Bishop, Operations Manager.

Admiral Metals has a unique customer-focused operating philosophy that has been at the foundation of its warehouse practices for many years. The Company’s production is based on the customer need for delivery the next day, unlike most companies that are focused solely on driving yield. “A fast turnaround means our production is streamlined with minimal overstock,” says Don Bishop, Operations Manager.

“As a result, our customers can rely on our delivery to help them run their businesses more efficiently. It’s a win-win for everyone.”

Don Bishop has been with Admiral Metals for 27 years, 11 as Admiral’s Operations Manager.