Copper has long been considered a leading indicator of global economic health. More than any other base metal, copper is tied closely to manufacturing, electrical engineering, industrial production, information technology, construction, and the medical sector. In general, rising copper prices have indicated strong demand and global economic strength; lower prices, a weaker economy.

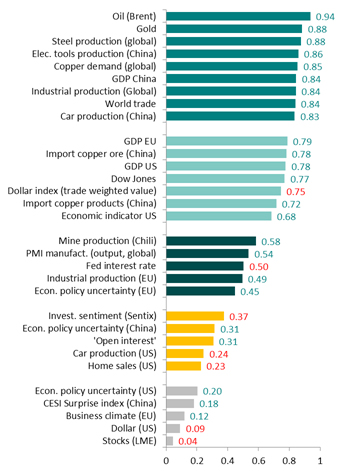

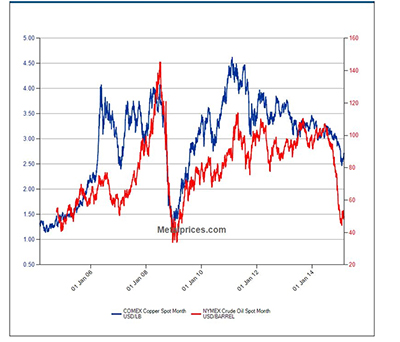

Historically, the price of copper has been strongly correlated with the price of gold, the Chinese economy, world trade, and most consistently, with the price of oil. Oil and copper tend to be affected by the same economic factors. In addition, energy costs comprise about 30{41f8e085fc68038a2da2699f98ad8aea8b7e87e25f742017f6f76a0b55118d3c} of the cost of copper extraction and up to 50{41f8e085fc68038a2da2699f98ad8aea8b7e87e25f742017f6f76a0b55118d3c} of the smelting and refining process. Long-term, as the price of oil fluctuates, so has the price of copper.

Is there a difference now?

According to Darren Gaudreault, Admiral’s Vice President of Purchasing, “There are economic drivers indicating the correlation between copper and oil prices may be weakening over time.” While global economic factors continue to connect them, there are separate influencers affecting each commodity’s supply and demand. On the supply side, fracking has increased US oil production to nearly 9 million barrels a day, and domestic crude oil reserves hit 36 billion barrels in 2013 for the first time since 1975 (source: US Energy Information Administration). This trend is expected to continue. Our lower dependence on foreign oil has forced producers who once sold to the US to compete on price with an increasing number of suppliers in Asian markets, as well.

In addition, demand for oil has been reduced by now longstanding greener alternatives and gas mileage reduction in our vehicles. All of these factors have brought oil costs from over $100 a barrel to closer to $60, as of late.

Copper prices have declined as well, but foreconomic factors that are different from oil. What has affected copper prices is fluctuating demand from China. While demand from China is still growing, according to the research company, CRU Group, growth will slow to 4 percent in 2015, down from 5.5 percent in 2014. In addition, Chinese lenders that allowed copper to be used as collateral on loans find themselves under water as the value of copper declined. Yet, unlike oil, supply and demand of copper has not been as volatile; there is no indicator of a large change in copper supply now or in the near future.

What are the long-term implications?

Improved technology, increased use of alternative sources of energy, larger oil reserves and a fluctuating Chinese economy are all factors that have led to a weakening of the relationship between oil and copper prices. A look at the graph above indicates the impact; while the price of copper is beginning to move up, oil prices have remained flat. But it is hard to argue with a 20-year average correlation of .94. We can envision the two becoming less related, but long-term, a full decoupling is difficult to imagine. They are still very much connected.

We’d like to hear your thoughts on the topic. Do you foresee a strong correlation between the price of copper and the price of oil, or do you think the two will decouple over time? What are the long-term implications if oil is no longer a good predictor of copper prices?

At Admiral Metals, we keep a close eye on global trends that affect our industry. Copper has been an important part of our product mix since we opened our doors more than 60 years ago, and the price of oil certainly has had an impact on deliveries both from suppliers and to our customers. We’re dedicated to staying well informed and to helping our customers stay on top of the global trends that impact their businesses.

What is the future of the workplace?

This last year and half have been filled with uncertainty whether you are a company owner or an employee working for someone else. During...